when are property taxes due in madison county illinois

Subsequent installments are due on Sept. To search for tax information you may search by the 15 to 18 digit parcel number last name of property owner or site address.

Exemptions Available Madison County Fl

In most counties property taxes are paid in two installments usually June 1 and September 1.

. Property Tax Village Of River Forest Cook County collects on average 138 of a propertys assessed fair market value as property tax. Welcome to Madison County Illinois. The median property tax in Madison County Illinois is 2144 per year for a home worth the median value of 122600.

LAST DAY TO PAY PROPERTY TAXES FOR TY 2020 ON OUR WEBSITE WILL BE FEBRUARY 18 2022 at 430 pm. Tax Rates and Tax. County Board Rules Related to Public Comment.

Illinois has one of the highest average property tax rates in the country with only six states levying higher property taxes. Taxes are paid in four installments and the first installment is due in July the second is in September the third in October and the last in December. Madison County Property Tax Inquiry.

Main Street Ste 125. In fiscal year 2016 property taxes. Property tax due dates for 2019 taxes payable in 2020.

County Minutes. With the help of this. Madison County Property taxes are paid in four installments.

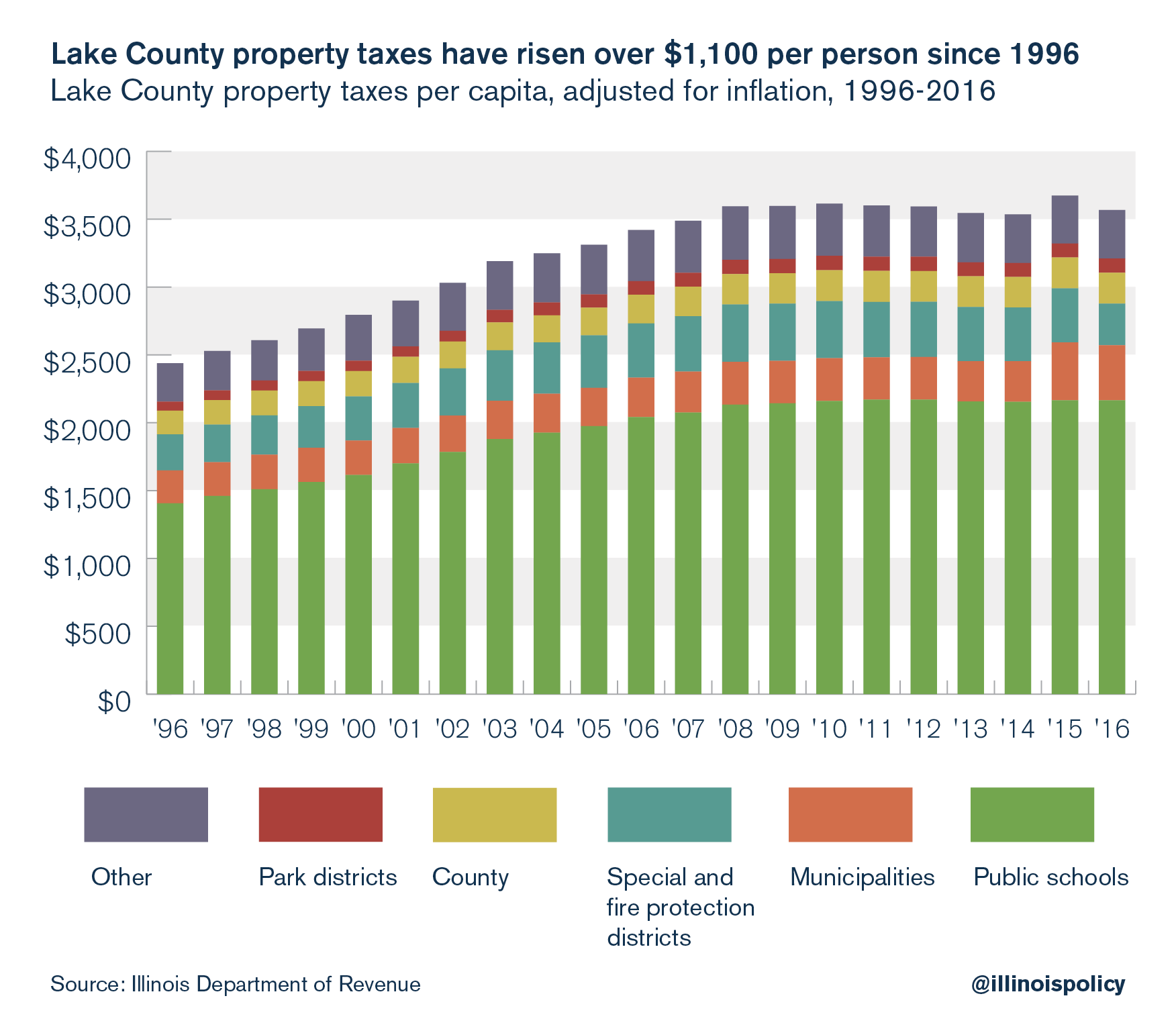

The first in July the second in September the third in October and the last. When are property taxes due in madison county illinois Tuesday March 15 2022 Edit Lake County collects the highest property tax in Illinois levying an average of 628500. Taxes are due in four installments.

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on. Madison County Il Property Tax Due Dates When are taxes due. Property taxpayers who plan.

When are property taxes due in madison county illinois Friday March 11 2022 Edit Clair County has one of the highest median property taxes in the United States and is. The first one is due on July 9. In Madison County property owners can pay in four installments.

830a Parks Enhancement Program. Madison County collects on average 175 of a propertys. The first installment is due in July the second is in September the third in October and the last in December.

You are about to pay your Madison County Property Taxes. 330p Information Technology Committee. Illinoiss median income is 68578 per year so the median yearly.

Welcome to Madison County IL. When are taxes due.

Lawmakers Are Expected To Make Big Changes To Judicial Circuits Across The State Without Much Public Notice Madison St Clair Record

Madison County 1812 2012 Reflecting Illinois And National History Madison Historical

Madison County Tax Assessor S Office

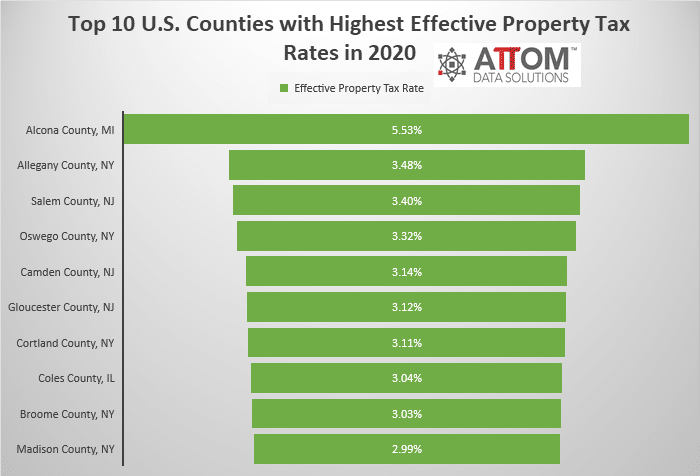

Top 10 U S Counties With Highest Effective Property Tax Rates Attom

Madison County Treasurer S Office Website Design Visual Lure

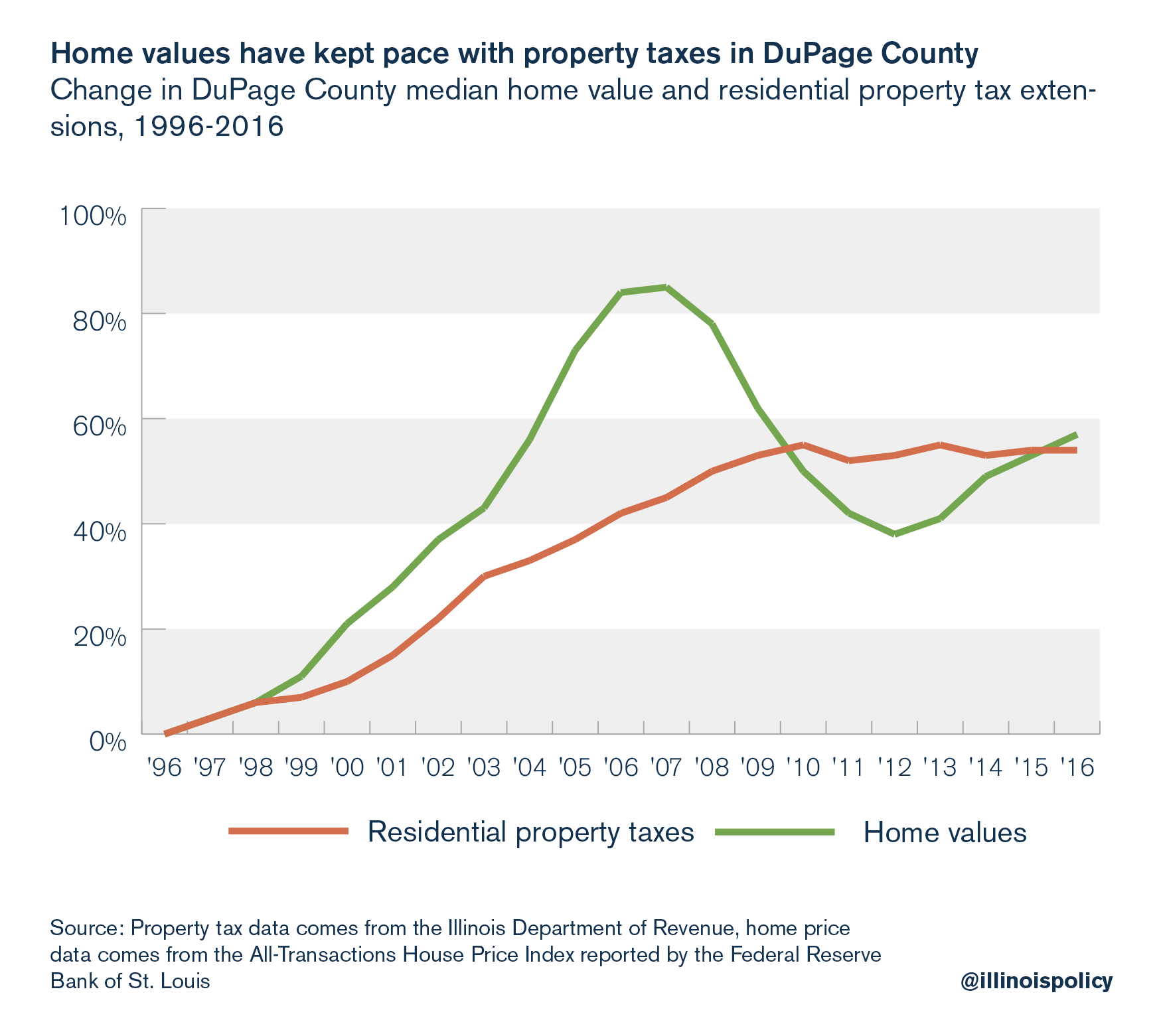

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

Madison County Treasurer To Offer Grace Period For First Tax Payment News Advantagenews Com

Kurt Prenzler Cpa Madison County Chairman

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

East St Louis Cahokia Il Eligible For Property Tax Relief Belleville News Democrat

Illinois 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Illinois Property Tax Calculator Smartasset

Illinois Property Tax Calculator Smartasset

Madison County Il Real Estate Madison County Il Homes For Sale Zillow

Local Taxes Edwardsville Illinois

Emergency Management Madison County Ny

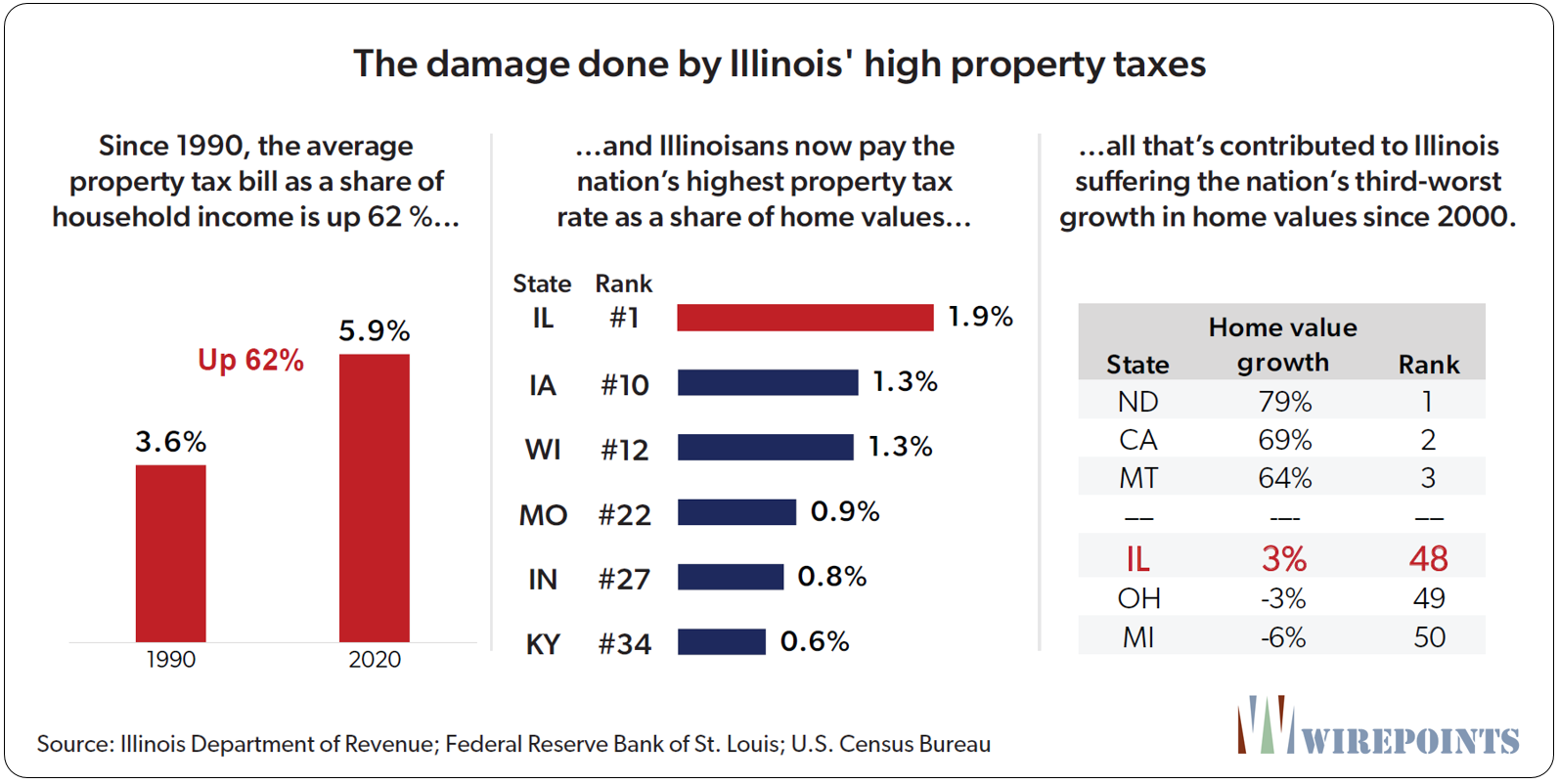

Thirty Years Of Pain Illinoisans Suffer As Property Tax Bills Grow Far Faster Than Household Incomes Home Values Madison St Clair Record